For small business owners, understanding the concept of assets, liabilities, and equity is essential to make smarter growth decisions and avoid costly compliance mistakes. In this blog post, we’ll discuss what assets, equity, and liabilities really mean for your business and how to use them in making informed business decisions for long-term success. Your business must have a record of every transaction, accounts payable and receivable to ensure you are on the right track of your business growth. Considering help from a reliable bookkeeper in Melbourne would be a great decision.

What are your business’s assets?

Assets are resources that your business owns and that generate future value. Current assets include cash, accounts receivable, and inventory, which are liquid and essential for daily operations. Non-current assets comprise property, equipment, and intangible assets such as trademarks or software. Here are some common types of assets:

- Accounts receivable: Any payments that your clients owe you.

- Cash: The money in your business bank account.

- Inventory: Any goods in your stock that you want to sell.

- Equipment and property: Any tools or buildings that you need to run your business.

Generally, assets are divided into two categories:

- Current assets: Cash and anything that can be converted into cash within a year.

- Fixed assets: Things like trademarks, land, and the value of your brand.

What are your business’s liabilities?

Liabilities are what you owe to others.

- Current liabilities: They include short-term loans, accounts payable, and payroll obligations.

- Long-term liabilities: They cover mortgages, debt, or bonds payable.

Keeping liabilities under control can help with cash flow management and ensure stability, especially during slower revenue time periods. To manage the cash flow of your business, you can reach out to a bookkeeper for a small business. To understand liabilities, have a closer look at the business liabilities:

- Accounts payable represent the payments you owe your suppliers.

- Wages and salaries payable that you have agreed to pay your workers in the future, but haven’t paid yet.

What is your business equity?

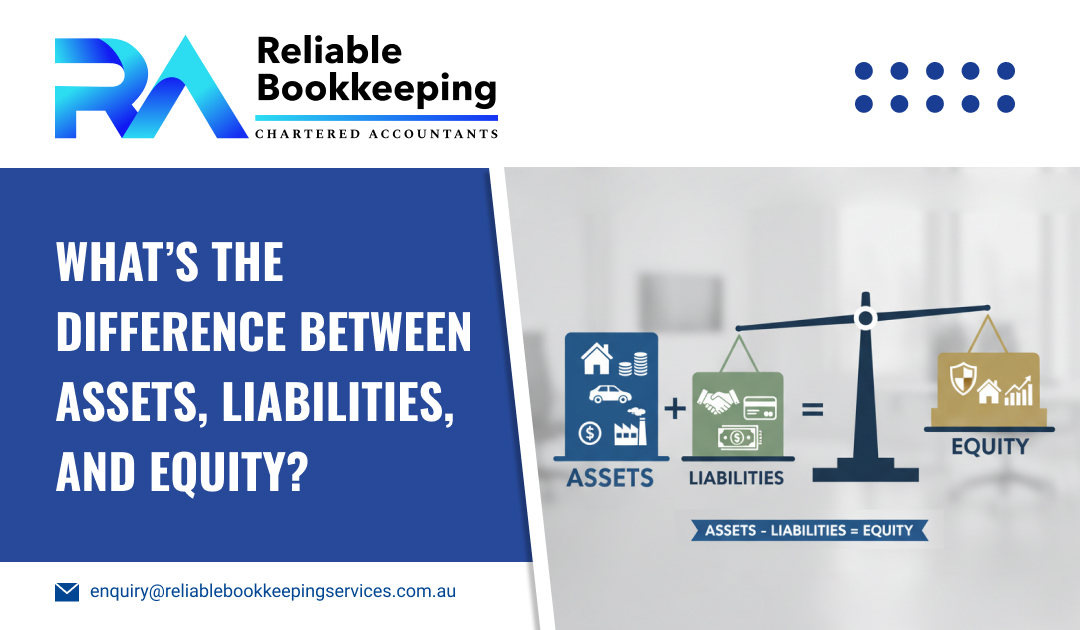

The value left after subtracting liabilities from assets is known as equity. It shows ownership in the business.

- Owner’s equity grows through retained earnings and direct investment.

- Dividends or distributions minimise equity when profits are taken out.

Why is it important to track your business’s liabilities and assets?

There are many reasons why you must monitor your business’s liabilities and assets, including:

- Investor relevance: Investors can assess the financial status of your company before committing capital.

- Cash flow management: Monitoring short-term assets and liabilities can help ensure you can meet obligations.

- Operational control: Tracking accounts payable and receivable keeps the business stable.

Best practices for financial management and compliance

For financial management and compliance, you can follow the tips given below:

- Reliable record-keeping of your business

Good and accurate financial records are the foundation of accurate financial reporting. Latest accounting systems make it easy and simple to upload receipts and connect bank accounts. This can reduce the chance of making errors.

- Year-round tax planning

Instead of worrying about tax returns, ongoing tax planning can help:

- Align with deadlines

- Uncover tax deductions

- Reduce your tax burden

- Make smart business decisions.

You can also engage a tax return accountant for year-round tax planning, ensuring you are lodging your tax return accurately. Accurate tax return lodgment can reduce the chance of tax penalties imposed by the ATO.

- Be ready for the audit

Even compliant businesses might face an audit. You must always be ready for an audit, along with expert support and insights that can help protect your business.

Liabilities, assets, and equity are important to understand for every business owner. They provide information about how much you have, what’s left over, and how much you owe.

Conclusion

Without understanding the concept of liabilities, equity, and assets, you won’t be able to stay on top of your business finances. By keeping your business books organised, tracking cash flow, and managing business finances, you can run your business successfully. You can benefit from reliable bookkeeping services to ensure you haven’t made any errors recording your financial transactions.