Bank Reconciliation

What is a Bank Reconciliation Statement?

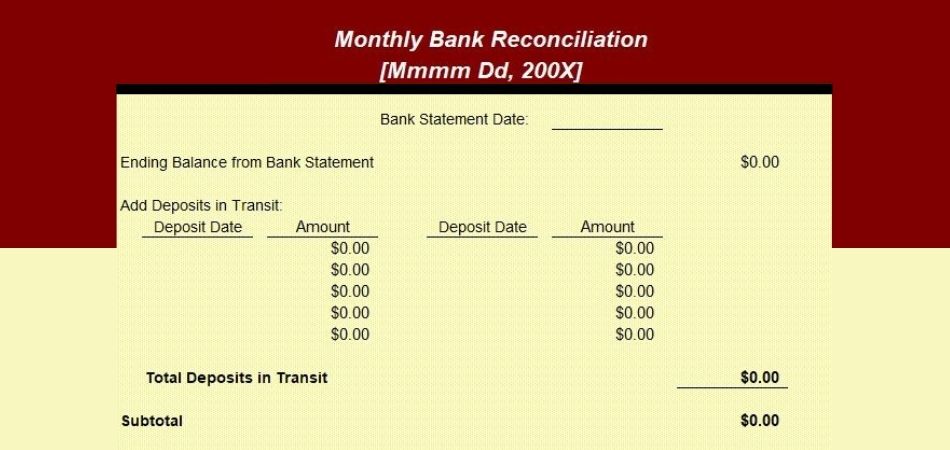

The bank reconciliation statement is prepared to compare the balance in the company’s accounting records with its bank account balance. It summarises business and banking activity and confirms that payments have been processed and collected cash has been deposited into a bank account.

This bank statement can be supplied with the bank and created after analyzing the corresponding amount presently there in the accounting records of the organization.

Bank reconciliation is vital from Melbourne bookkeeping services for maintaining the books. This makes data entry from your bank accounts on a daily, weekly, or monthly basis to your accounting software. Bank reconciliation calculates the credits and debits in line with accounting software. Matching bank reconciliation creates a balance in the trial balance for financial statement review.

There are some of the services from us that make you like easy includes: we made a banking transaction, like when you receive the credit card or having any of the changes made by the bank which are not available in the organization books. We suggest you issue cheques if required, that have not been presented to the bank. We are here to make your money matters error-free. With the help of our team of experts, we even correct the errors in case done by the bank or the organization.

We can reconcile the difference very easily by just giving a look at the recent bank statement transactions or while checking the accounting records. In case, there is any fault present or any kind of combination in tallies, then the issues would be resolved and at the same time, the explanation for the same would also be present as well. You needn’t go through the entire accounts and match every transaction because we can make done the necessary adjustments in the cash book and also report to the bank if required or done with timings adjustments or other records for future reconciliations.

The Process for Preparing the Bank Reconciliation Statement

The bank reconciliation process involves a few steps that must be followed carefully without making any mistakes. Our bookkeepers are experts in preparing required documents, comparing balances and transactions, and making corrections.

- Accessing Bank and Business Records

The first step of bank account reconciliation is collecting bank and business records. We will prepare a bank statement for a specific time period we want to reconcile and the business’s accounting records for that time period.

- Check the Starting Balance

After completing the first step of accounting bank reconciliation, we verify the opening balance on your bank statement to check if it matches the opening balance on your own accounting records. We make sure it is accurate.

- Review Transactions

Basically, the purpose of bank reconciliation is to detect errors and make corrections. That’s why we review your transactions. We compare your business’s account to your bank statement.

- Bank Statement Adjustment

If there are items on your business books and they are not present on the bank statement, then our bookkeepers will help to add them. Bank reconciliation’s purpose is to maintain an accurate measure of all transactions.

- Cash Account Adjustment

Your business’s cash account may need some adjustment. Our bookkeepers can help manage that adjustment which may include bank fees and other charges.

- Check the Closing Balance

After going through and matching each transaction, we compare the final closing balance on the bank statement to your business books. For every business owner, it is important to understand account reconciliation’s meaning.

Why is the Bank Reconciliation Statement Prepared?

It is crucial to know why it is important to reconcile bank accounts.

- Bank account reconciliation is used to spot discrepancies, duplications, and errors. Even minor mistakes could affect tax reporting and financial reporting.

- It can detect fraud, loss, and theft.

- It can help address issues with receivables, for instance, unpaid invoices.

- This statement provides you with a clear picture of your company’s cash flow.

Frequently Asked Questions (FAQs)

What is bank reconciliation in Australia?

Is a bank reconciliation statement the same as a balance sheet?

Basically, bank reconciliation accounting is the process of comparing your company’s balance sheet and bank account.

What are the most common errors in bank reconciliation?

One of the most common reasons behind bank account reconciliation errors is duplicate or missing transactions. You can also view the bank reconciliation report for more detailed information.

What to look for when bank reconciliation doesn’t balance?

It is important to check that all the reconciled transactions match your bank statement and have an accurate date.

Is bank reconciliation the same as bookkeeping?

Bank account reconciliation is one of the processes involved in bookkeeping that needs attention to detail. It matches the bank’s records with your business books to ensure they show the same amount.

Do bookkeepers reconcile bank accounts?

Bookkeepers are responsible for performing various tasks, including:

- Record financial transaction

- Reconcile bank accounts

- Manage bank feeds

- Handle accounts receivable

- Handle accounts payable

- Work with your tax accountant and assist with tax compliance

- Prepare financial statements

- Take on some payroll functions