Bank Reconciliation

What is a Bank Reconciliation Statement?

The bank reconciliation statement is prepared to compare the balance in the company’s accounting records with its bank account balance. It summarises business and banking activity and confirms that payments have been processed and collected cash has been deposited into a bank account.

This bank statement can be supplied with the bank and created after analyzing the corresponding amount presently there in the accounting records of the organization.

Bank reconciliation is vital from Melbourne bookkeeping services for maintaining the books. This makes data entry from your bank accounts on a daily, weekly, or monthly basis to your accounting software. Bank reconciliation calculates the credits and debits in line with accounting software. Matching bank reconciliation creates a balance in the trial balance for financial statement review.

There are some of the services from us that make you like easy includes: we made a banking transaction, like when you receive the credit card or having any of the changes made by the bank which are not available in the organization books. We suggest you issue cheques if required, that have not been presented to the bank. We are here to make your money matters error-free. With the help of our team of experts, we even correct the errors in case done by the bank or the organization.

We can reconcile the difference very easily by just giving a look at the recent bank statement transactions or while checking the accounting records. In case, there is any fault present or any kind of combination in tallies, then the issues would be resolved and at the same time, the explanation for the same would also be present as well. You needn’t go through the entire accounts and match every transaction because we can make done the necessary adjustments in the cash book and also report to the bank if required or done with timings adjustments or other records for future reconciliations.

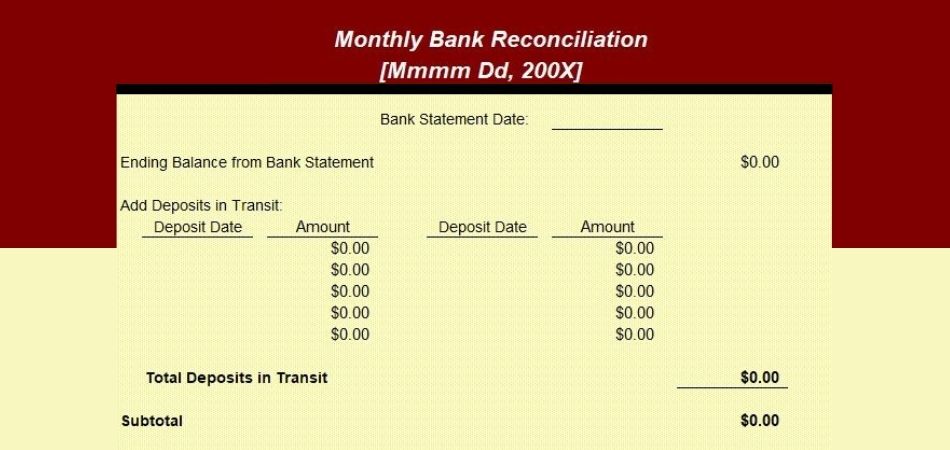

Here’s a bank reconciliation statement example: Suppose you are running a small shop with a lot of financial transactions and receive a lot of cash. In that case, bank statement reconciliation must be performed every day. However, if your shop encounters a few financial transactions, then you can prepare a bank reconciliation statement on a weekly or monthly basis.

The Process for Preparing the Bank Reconciliation Statement

Here’s how to do bank reconciliation:

Preparing a bank reconciliation report involves a few steps that must be followed carefully without making any mistakes. Our bookkeepers are experts in preparing required documents, comparing balances and transactions, and making corrections.

- Accessing Bank and Business Records

The first step of bank account reconciliation is collecting bank and business records. We will prepare a bank statement for a specific time period we want to reconcile and the business’s accounting records for that time period.

- Check the Starting Balance

After completing the first step of accounting bank reconciliation, we verify the opening balance on your bank statement to check if it matches the opening balance on your own accounting records. We make sure it is accurate. Balance sheet reconciliation ensures that the balance mentioned in the company’s balance sheet is accurate and matches the bank statements and general ledger.

- Review Transactions

Basically, the purpose of bank reconciliation is to detect errors and make corrections. That’s why we review your transactions. We compare your business’s account to your bank statement.

- Bank Statement Adjustment

If there are items on your business books and they are not present on the bank statement, then our bookkeepers will help to add them. Bank reconciliation’s purpose is to maintain an accurate measure of all transactions.

- Cash Account Adjustment

Your business’s cash account may need some adjustment. Our bookkeepers can help manage that adjustment which may include bank fees and other charges.

- Check the Closing Balance

After going through and matching each transaction, we compare the final closing balance on the bank statement to your business books. For every business owner, it is important to understand account reconciliation’s meaning.

Why is the Bank Reconciliation Statement Prepared?

By now, it’s clear how to do reconciliation. Now, you may be wondering: Why is it important to create a bank reconciliation report? It is crucial to know why it is important to reconcile bank accounts.

Importance of Preparing a Bank Reconciliation Statement

Bank account reconciliation stands as a crucial financial practice for any business. It involves comparing records of financial transactions in a company’s accounting system with the records given by the bank. Here are some reasons why it is crucial to reconcile your bank accounts:

- Detecting Errors

Errors can happen with a single missed financial transaction. These mistakes range from simple data entry errors to more complex issues like entering data twice or incorrect deposit amounts. With bank account reconciliation, you can easily identify errors early on and resolve them on time, ensuring the accuracy of your records.

- Spotting Fraudulent Activities

Fraudulent activities can occur if you don’t track your financial records or transactions. Bookkeepers in Melbourne can help you reconcile your bank accounts. Bank account reconciliation can help identify any fraudulent transactions or unauthorised activities that may have happened. By comparing your internal financial records with your bank statements, you can identify discrepancies or unfamiliar financial records, allowing you to take action to prevent further losses.

- Tracking Cash Flow

Cash flow management is an indispensable part of any business. Bank account reconciliation makes you able to track your income and expenses accurately. By reconciling your bank statements frequently, you can address any unexpected bank fees or delays in deposits, ensuring that your cash flow is optimised.

- Correct Financial Reporting

Ensuring timely and accurate financial reporting is essential for making well-informed business decisions. By reconciling your bank statements, you can guarantee that your financial statements accurately represent your company’s true financial standing. This accuracy provides stakeholders with the right information to check the health of your business. Financial reporting is also important for preparing for tax season. It helps small business tax accountants to prepare and file tax returns.

- Save Money

Bank reconciliation can help you save money by alerting you to the subscriptions and services you’re consistently paying for but not using. This includes services you may have signed up for as a free trial, only to have your card automatically charged at the end of the trial period. While you can cancel these subscriptions immediately, you could waste a lot of money if you only discover the automatic payments several months later.

How Does Bank Reconciliation Work?

- Gather Documents: Get bank statements and internal records, such as payments, receipts and deposit slips.

- Compare Outstanding Balances: Verify whether the initial balances in the company’s financial records align with those in the bank statement.

- Identify Deposits: Match bank deposits with internal records, including deposit slips and cash receipts.

- Detect Withdrawals: Align bank withdrawals with internal documentation. Additionally, verify the dates and amounts to ensure they match.

- Reconcile Outstanding Checks: Match checks issued with those cleared.

- Reconcile Outstanding Deposits: Match deposits made with those credited. Outstanding deposits are made by the company but have to be credited to the bank account.

- Consider Charges and Interest: Compare bank fees and interest earned.

- Adjust Records: Make necessary changes based on comparisons.

- Reconcile Closing Balances: Ensure closing balances of the company’s accounting records and bank statement match.

- Document Reconciliation: Create a statement detailing the process and adjustments.

Frequently Asked Questions (FAQs)

What is bank reconciliation in Australia?

Is a bank reconciliation statement the same as a balance sheet?

Basically, bank reconciliation accounting is the process of comparing your company’s balance sheet and bank account.

What are the most common errors in bank reconciliation?

One of the most common reasons behind bank account reconciliation errors is duplicate or missing transactions. You can also view the bank reconciliation report for more detailed information.

What to look for when bank reconciliation doesn’t balance?

It is important to check that all the reconciled transactions match your bank statement and have an accurate date.

Is bank reconciliation the same as bookkeeping?

Bank account reconciliation is one of the processes involved in bookkeeping that needs attention to detail. It matches the bank’s records with your business books to ensure they show the same amount.

Do bookkeepers reconcile bank accounts?

Bookkeepers are responsible for performing various tasks, including:

- Record financial transaction

- Reconcile bank accounts

- Manage bank feeds

- Handle accounts receivable

- Handle accounts payable

- Work with your tax accountant and assist with tax compliance

- Prepare financial statements

- Take on some payroll functions