Latest Blogs

What are Non commercial losses?

Non commercial losses A non commercial loss refers to a loss that comes from a business that is not very profitable in terms of money or assets as of now for an individual or in a partnership. This can be a business that just started off or has not made significant...

What are included in Bookkeeping Service?

Bookkeepers ensure that the expenses, income, and transactions of the company are recorded in the books and reconcile the financial accounts on the monthly basis. Bookkeepers could also assist with the financial statement and financial report preparation. The...

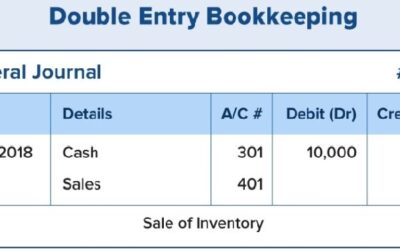

What is Double-Entry Bookkeeping

Double-entry bookkeeping is a concept in which all the accounting transactions influence the finances of the company in two ways. Basically, the general ledger records two sides of every transaction: * Double-entry bookkeeping implies that every accounting transaction...

New Opportunities & Risks in 2021 By Australian Government amidst COVID-19

There is a long wait for returning to “normal”, with the borders between the State and Territories all but open and 2021 insight. The Reserve Bank of Australia has cautioned that the recovery will be uneven and GDP is not expected to reach the level it was before the...

What Happens if You Neglect Your Bookkeeping?

How to fix bad bookkeeping (and what happens if you ignore your books for too long) Many entrepreneurs find bookkeeping a tedious and time-consuming task. However, if they ignore the part of bookkeeping they will certainly create many problems for themselves....

Bookkeeping Is Essential To Grow Your Small Business.

Accounting is about making use of financial data to drive decision making. This data gets prepared by bookkeeping services. The tasks of bookkeeping include the process to track the assets, liabilities, income, and expenses of the business to assist you to make smart...

How to Bookkeep

Keeping a record of transactions plays a crucial role for all the businesses in building a sturdy foundation for a business for the good financial health of the business. Almost all the business owners are of the viewpoint that tax preparation and bookkeeping are the...

Basic Bookkeeping for Your Small Business

Accounting is about making use of financial data to drive decision making. This data gets prepared by bookkeeping services. The tasks of bookkeeping include the process to track the assets, liabilities, income, and expenses of the business to assist you to make smart...

Accounting Vs. Bookkeeping – What’s the Difference

When many people think about accounting and bookkeeping, it could be harder for them to explain the differences between them. As the accountants and bookkeepers have common goals to do, they assist your business in distinct stages of the financial cycle. Bookkeeping...

Bookkeeper Near Me

Are you searching the web for “Bookkeeper Near Me”, then stop, you don’t have to make any more efforts. You can avail professional bookkeeping services here at Reliable Bookkeeping Services. Our bookkeepers are dedicated to making the bookkeeping of your business...

Federal Budget from Government 2020-2021

On October 6th, 2020, the Federal Budget 2020-21 was handed down which was delayed from usual time of May. The legislation has been introduced to present effect to the number of measures related to the tax declared on the budget night. Some of the proposed changes in...

Jobmaker Hiring Credit: how does it work and who is eligible?

The JobMaker Hiring Credit will assist to boost the growth in the employment of young people during the Coronavirus recovery. The JobMaker Hiring Credit will provide the businesses incentives to take on additional young job seekers. The JobMaker Hiring Credit is...

Facts About Bookkeeping Services For Small Businesses

You’ll definitely find your business running more smoothly with a professional bookkeeper’s assistance. Bookkeeping is the process to record transactions that are made in the business. With the assistance of bookkeeping, the business owner may analyze whether the...

Updates in JobKeeper Payment and Grants during COVID-19

Under Victoria’s Business resilience package announced by Prime Minister, some of the grants will be exempted from income tax; still, its legislation is due. BY GOVERNMENT The extension and alternative tests have been confirmed with JobKeeper 2.0 details. The...

Accounting for Startups: Why your business needs bookkeeping services?

Do you need to know about learning the services that you will require to run your business smoothly, being a startup? To simplify your business, do you need to invest from your startup business to get the services of a bookkeeper for your business? As the start-ups...

Tips to Find the Best Tax Preparer near You

While choosing an accountant, you must rely on one who suits you and your business. Some of the accountants are specialized in tax returns for individuals or businesses of a specific industry and others in specific areas of tax. According to a survey, about a third of...

How to Write a Business Plan to Start a business

All the businesses must follow a written business plan, Isn’t it? Some businesses require business plans to attract investors or some to provide direction. In all the scenarios, a business plan plays a significant role in the success of an organization. An efficient...

New Rules in Jobkeeper 2.0

The treasurer released the detailed rules that deal with the extension mentioned in the JobKeeper scheme till March 28th, 2021.The guidance by ATO and the explanatory statement flesh out the previous wordings of the treasury on the manner in which the JobKeeper Scheme...